St-Georges Eco-Mining Corp. (CSE:SX)(OTCQB:SXOOF)(FSE:85G1) is pleased to announce that it has filed a provisional patent covering a new breakthrough achieved in the spodumene processing and lithium hydroxide production technologies.

Highlights

– 92% of Nitric acid recirculated into hydrometallurgical process Resulting in Zero Waste Lithium Production

– Continuous reaction in saturated solution growing lithium crystals with no energy added

– Significant cost savings

– 98% recovery of Lithium in spodumene with 99% purity in Lithium Hydroxide Crystal

– Improved optionality to process multiple sources of feedstock using the same process

– Lithium Production Plant Engineering Study Initiated with WSP

– Spodumene Concentrate Feedstock discussions underway with 3 potential clients.

Over the last few years, St-Georges’ metallurgical team has been developing a process using material from multiple mining sources which allows the production of lithium hydroxide and lithium metals from hard rock spodumene concentrates. Our unique approach allows for all the nitric acid used in the process to be either recirculated or amalgamated into fertilizer by-products. Because the majority of the acid is being recirculated, what is left in the waste product is of no significance and thus requires little to no neutralizing before it can be sold to cement and asphalt producers. Thus, the process produces no tailings and monetizes all the input materials making it one of the greenest processes on the market today.

Tests have shown that an average of 92% of the nitric acid used in our process gets recirculated and The Company’s metallurgists believe that with ongoing testing this could be improved to a theoretical limit of 95% by reducing the humidity level during prior stages of the process.

Other improvements to various aspects of the processing technology not only represent major energy saving in the pretreatment phase of the process, but also in the production of battery grade lithium hydroxide and lithium metal from other hard rock sources that traditionally require heavy heat and energy input to break down the material. However, the most significant cost savings come from the fact that St Georges can produce 99.99% pure Lithium Hydroxide in one step after novel treatment of the lithium in solution through the use of an electro-winning method, thus omitting the need to ship lithium concentrates to a third party for refining. It also gives North America a solution for hard rock resources.

It is important to note that the technology can also be used with lepidolite, petalite and zinnwaldite, leveraging the improvements to the calcination treatment and has been incorporated into this patent application.

Applications to Battery Recycling

The technology was also tested with Lithium and with Lithium-Iron-Phosphate used batteries with significant novel improvements and costs reductions, improving the recovery of the strategic mineral and the commercial viability of the operation by magnitudes.

“I believe this process bridges the gap between the good brines and hard rock resources available around the world. In Canada, we have made large efforts and investments and have yet to achieve a viable solution which is why I am very excited by the progress achieved from our team because we believe we have the solution to unlock North American hardrock lithium resources. In saying that, we view ourselves as a complement to the industry and look forward to working with our peers to help advance lithium projects and meet the growing demand. On a personal note I believe resources should be evaluated for their resource and technology. By combining the right options billions of dollars can be saved,” said Enrico Di Cesare, CEO of St-Georges Metallurgy Corp.

“Until now, developers of lithium projects and spodumene concentrates producers might have perceived us as just another novel process using different acid mix and a few other witty twists… moving forward, it will become difficult for everyone planning a production project to ignore the potential savings in building and operating a plant that won’t require much energy… after the reaction is started there is no electrolysis and no additional heat applied, the saturated solution just grows lithium crystal as long as feedstock is added… I can’t imagine a simpler tech to operate,” commented Frank Dumas, COO of St-Georges Eco Mining Corp.

Lithium Processing plant

Now that The Company has completed the review of the engineering concepts supporting the design and building of a hybrid lithium hydroxide and lithium metals plant, St-Georges has contracted WSP to model the process and establish capital costs associated with the tech plant.

We look forward to updating shareholders upon the completion of the study.

Feedstock Agreements Under Discussion

Currently, St-Georges is awaiting the arrival of 3 different shipments of approximately 200 kg each of spodumene concentrates from companies operating spodumene mines in South African countries. Once received, The Company will process this material and use the data obtained to negotiate a fair profit-sharing agreement with the producers of the concentrates.

Additionally, The Company is in talks with several different producers, developers and mineral explorers to secure spodumene concentrate. As developments occur, updates will be provided.

Nickel & Chromium Developments

St-Georges’ metallurgists received the results of additional independent tests conducted with one of its contracted facilities in Ontario in relation to its Nickel and Chromium research and development.

The Company produced stainless steel in a single step from material obtained from spent batteries and nickel from mineral resources.

St-Georges is in continuous development for customized solutions for different battery recycling with these initiatives currently completed:

– Spodumene lithium process that works with lithium-ion batteries and can combine mineral resources and battery recycling efficiently with no tailings or output footprint.

– Alkaline batteries have been optimized for fertilizer and new results show that they can be converted to ferro manganese using renewable carbon resources like char.

– Nickel cadmium batteries were successfully converted to ferro nickel and stainless steel.

The latter is a major improvement and warrants further work with our resources and complementary resources such as chromium besides the battery recycling initiatives.

All the testing work was carried out by independent laboratories.

Further work is being initiated for other hydrometallurgical options potentially more efficient in different geographical regions, such as Italy with The Company’s potential partner Arabat that is using orange peels and other by products of orange juice production.

ON BEHALF OF THE BOARD OF DIRECTORS

Frank Dumas

Director & COO

About St-Georges Eco-Mining Corp.

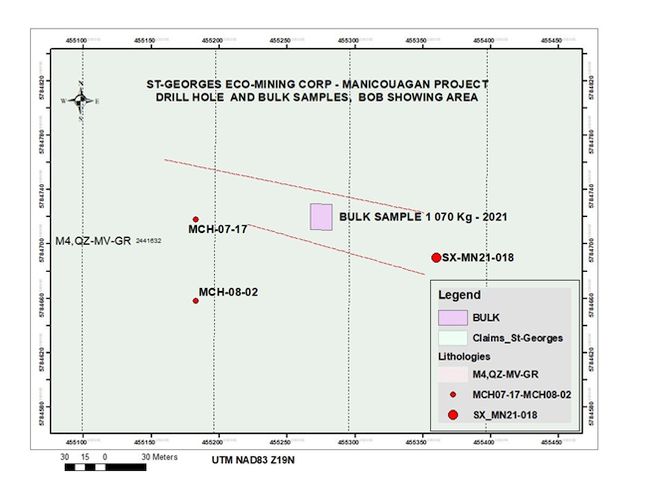

St-Georges develops new technologies to solve some of the most common environmental problems in the mining sector, including maximizing metal recovery and full circle EV battery recycling. The Company explores for nickel & PGEs on the Julie Nickel Project and the Manicougan Palladium Project on Quebec’s North Shore and has multiple exploration projects in Iceland, including the Thor Gold Project. Headquartered in Montreal, St-Georges’ stock is listed on the CSE under the symbol SX and trades on the Frankfurt Stock Exchange under the symbol 85G1 and on the OTCQB Venture Market for early stage and developing U.S. and international companies under the symbol SXOOF. Companies are current in their reporting and undergo an annual verification and management certification process. Investors can find Real-Time quotes and market information for the company on www.otcmarkets.com Visit St-Georges’ web site at www.StGeorgesEcoMining.com

The Canadian Securities Exchange (CSE) has not reviewed and does not accept responsibility for the adequacy or the accuracy of the contents of this release.

SOURCE: St-Georges Eco-Mining Corp.