Doubleview Gold Corp. (TSXV: DBG) (OTCQB: DBLVF) (FSE: 1D4) (“Doubleview” or the “Company”) is pleased to announce the completion of its 2025 drilling season at the Hat Polymetallic Project in northwestern British Columbia. This year’s program marks the largest drilling campaign in the Hat Project’s history, with 13,290 metres drilled across 19 drill holes, achieving a 100% success rate with every drill hole intersecting mineralization, while confirming the deposit remains open to depth and laterally.

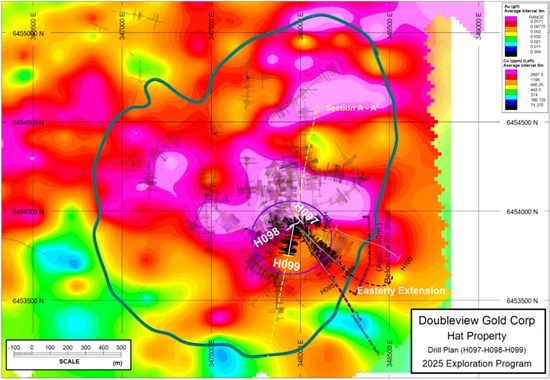

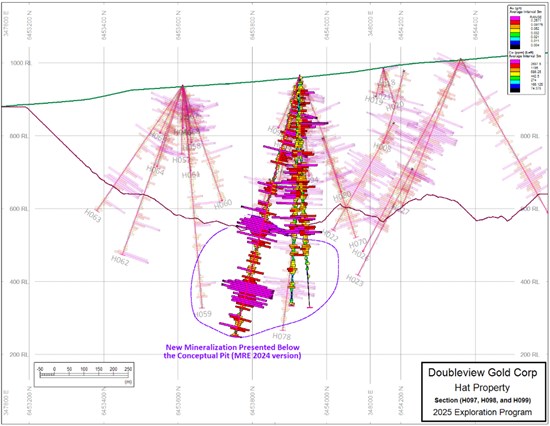

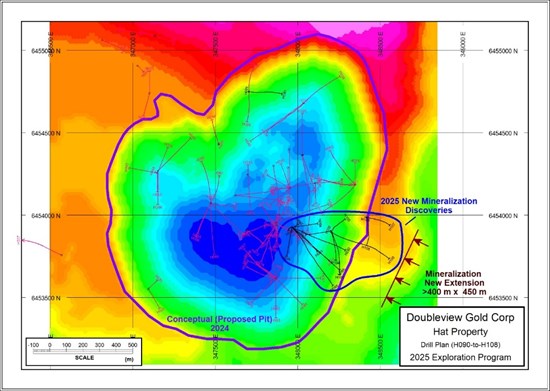

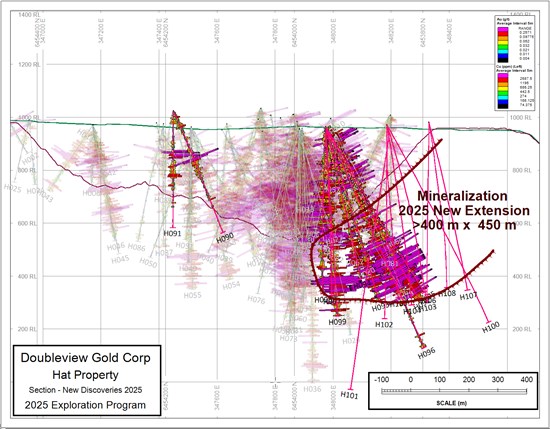

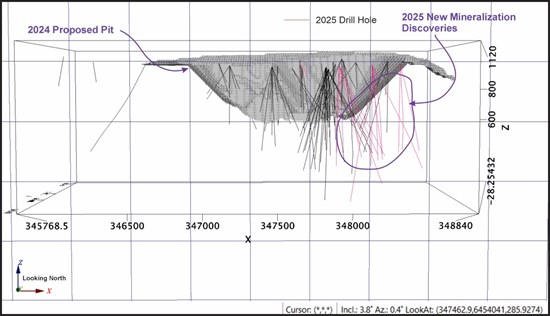

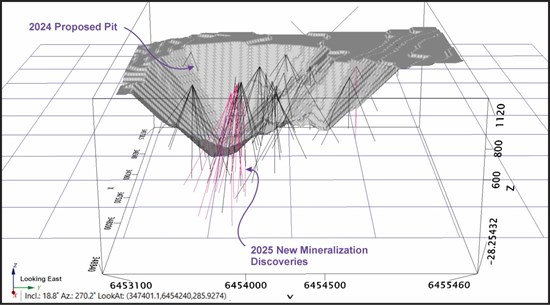

The 2025 campaign delivered major advancements in our understanding of the geology and dimensions of the Hat deposit, including the identification of a newly recognized mineralized horizon located beneath and adjacent the 2024 conceptual open-pit shell. Importantly, mineralization domains were better defined, existing data gaps were closed, and the Company’s evolving geological and resource models were validated (see Figures 1-4, also available on the Company’s website at www.doubleview.ca).

Assays from holes H100 through H108 remain pending and will be released once received, reviewed, and interpreted in accordance with NI 43-101.

Highlights of the 2025 Drill Season

- 13,290 metres drilled in 19 holes, averaging 699.5 metres per hole — the largest and most efficient and technically productive program ever.

- A newly discovered deep mineralized horizon beneath the 2024 conceptual pit outline confirms significant down-dip continuity and expansion potential as mineralization remains open at depth and laterally in multiple directions.

- Every drill hole intercepted mineralization, demonstrating the strength and continuity of the porphyry system.

- H097, H098, and H099, previously disclosed, extended mineralization by 200-300 metres down-dip and up to 100 metres laterally, significantly improving the block model and geological interpretation.

- H099 returned 438 m of 0.40% CuEq, including 52 m of 1.02% CuEq, another one of the strongest continuous intervals drilled at the Hat to date.

- Newly completed holes H100-H108 were strategically positioned to evaluate depth extensions, lateral continuities, and untested model gaps. Core samples from these drill holes are being processed at the independent assay lab.

- Pending assays for nine remaining holes will inform updates to the Mineral Resource Estimate (MRE-2) and the ongoing Preliminary Economic Assessment (PEA). Note: Due to timing issues, we may not be able to include all assay data in those technical reports.

- 2025 work further advances Doubleview’s understanding of copper-gold-cobalt-scandium mineral domains. The recently-announced potential scandium recovery achievements are a major milestone for the Hat’s critical-metals profile.

Farshad Shirvani, President & CEO, commented:

“This has been a transformational year for Doubleview and the Hat Project. Our 2025 drill campaign successfully demonstrated the strength of our geological model, filled key data gaps, and uncovered an entirely new mineralized horizon beneath the 2024 conceptual pit shell. Every drill hole intersected mineralization, which is a testament to the quality and strength of our technical team, along with the robustness of the system.

The discovery potential at Hat continues to expand, with the deposit remaining open both laterally and at depth. Combined with last year’s exceptional drill results, our scandium recovery breakthrough, and the ongoing work toward the updated Resource Estimate and PEA, we are entering the next phase of project development with a high degree of confidence and momentum. I extend my thanks to our technical team, contractors, and shareholders for enabling the most successful drilling season in our Company’s history.”

The Company is now focused on completing the assay review and disclosure for drill holes H100 through H108, which represent the final nine holes of the 2025 program. Assay results, when received, verified, and interpreted in accordance with NI 43-101 standards, will be announced and incorporated into the geological and resource models.

In parallel, the Company continues to advance its Preliminary Economic Assessment (PEA), which is currently undergoing both internal modelling and external third-party review. The integration of the full 2025 drill dataset, including pending assays, is expected to materially enhance the confidence and robustness of the forthcoming PEA, supporting a comprehensive evaluation of the Hat Project’s economic potential and paths to development.

Figure 1: Drill plan and 2025 Extension around the 2024 Conceptual Pit

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8003/277248_9efb9102e4f63b8e_001full.jpg

Figure 2: 2025 drilling, mineralization extension at depth and around the 2024 conceptual pit

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8003/277248_9efb9102e4f63b8e_002full.jpg

Figure 3: 2024 Conceptual pit shell in 3D and 2025 drill holes demonstrating the strategic exploration in 2025

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8003/277248_9efb9102e4f63b8e_003full.jpg

Figure 4: 2024 Conceptual pit shell in 3D and 2025 drill holes demonstrating the strategic exploration in 2025

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8003/277248_9efb9102e4f63b8e_004full.jpg

Doubleview maintains a website at www.doubleview.ca.

Qualified Persons:

Erik Ostensoe, P. Geo., a consulting geologist, and Doubleview’s Qualified Person with respect to the Hat Project as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, has reviewed, and approved the technical contents of this news release. He is not independent of Doubleview as he is a shareholder in the company.

About Doubleview Gold Corp

Doubleview Gold Corp. is mineral resource exploration and development company headquartered in Vancouver, British Columbia, Canada. It is publicly traded on the TSX-Venture Exchange (TSXV: DBG), (OTCQB: DBLVF), (WKN: LA1W038), and (FSE: 1D4). Doubleview focuses on identifying, acquiring, and financing precious and base metal exploration projects across North America, with a strong emphasis on British Columbia. The company enhances shareholder value through the acquisition and exploration of high-quality gold, copper, cobalt, scandium, and silver projects-collectively critical minerals utilizing cutting-edge exploration techniques.

Doubleview’s success is deeply rooted in the unwavering support of its long-term shareholders, supporters, and institutional investors. Their ongoing commitment has been instrumental in advancing the company’s strategic initiatives. Doubleview looks forward to further collaborative growth and development and continues to welcome active participation from its valued stakeholders as the company expands its portfolio and strengthens its position in the critical minerals sector.

About the Hat Polymetallic Deposit

The Hat Deposit, located in northwestern British Columbia, is a polymetallic porphyry project with major resources of copper, gold, cobalt, and the potential for scandium. As one of the region’s significant sources of critical minerals, the Hat deposit has undergone targeted exploration and development. The 0.2% CuEq cut-off resource estimate, as of the recently completed Mineral Resource Estimate and the Company’s July 25, 2024, news release, is summarized below:

Open Pit Model Hat | Resource Category | Tonnage | Average Grade | Metal Content | ||||||||

| CuEq | Cu | Co | Au | Ag | CuEq | Cu | Co | Au | Ag | |||

| Mt | % | % | % | g/t | g/t | million lb | million lb | million lb | thousand oz | thousand oz | ||

| In Pit | Indicated | 150 | 0.408 | 0.221 | 0.008 | 0.19 | 0.42 | 1,353 | 733 | 28 | 929 | 2,045 |

| Inferred | 477 | 0.344 | 0.185 | 0.009 | 0.15 | 0.49 | 3,619 | 1,945 | 91 | 2,328 | 7,575 | |

Scandium potential for the Hat Deposit is estimated to be 300 to 500 million tonnes at an average grade of 40 ppm (0.004%) Sc2O3.

For further details of the MRE, please refer to the Company’s July 25, 2024 news release.

On behalf of the Board of Directors,

Farshad Shirvani, President & Chief Executive Officer

For further information please contact:

Doubleview Gold Corp

Vancouver, BC Farshad Shirvani

President & CEO

T: (604) 678-9587

E: corporate@doubleview.ca

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Certain of the statements made and information contained herein may constitute “forward-looking information.” In particular references to the private placement and future work programs or expectations on the quality or results of such work programs are subject to risks associated with operations on the property, exploration activity generally, equipment limitations and availability, as well as other risks that we may not be currently aware of. Accordingly, readers are advised not to place undue reliance on forward-looking information. Except as required under applicable securities legislation, the Company undertakes no obligation to publicly update or revise forward-looking information, whether as a result of new information, future events or otherwise.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/277248