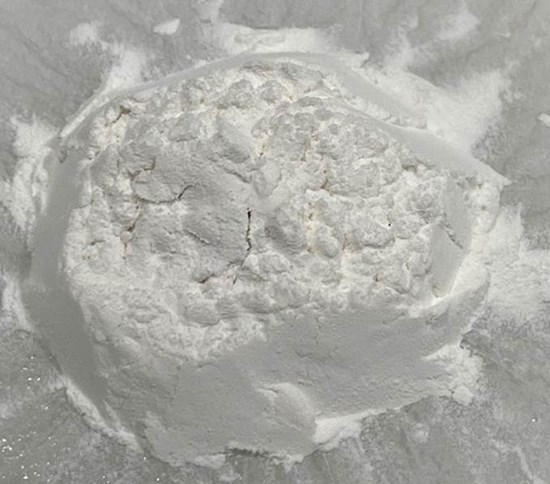

Doubleview Gold Corp. (TSXV: DBG) (OTCQB: DBLVF) (FSE: A1W038) (FSE: 1D4) (“Doubleview” or the “Company”) is pleased to announce positive first-phase pre-optimization results from its two-year, novel scandium-focused metallurgical test program. These results confirm the technical viability of recovering high-purity scandium oxide alongside copper, gold, cobalt, and other metals from the Company’s 100%-owned flagship HAT polymetallic deposit in northern British Columbia.

This breakthrough development marks a global first: The successful recovery of scandium from copper porphyry flotation tailings to a scandium oxide product.

The primary objective of this extensive test program, conducted at SGS Canada Inc., was to establish a viable proprietary flowsheet enabling scandium to be included in the upcoming, updated mineral resource estimate and preliminary economic assessment, potentially as measured, indicated, or inferred resources. The Company’s maiden resource estimate (July 25, 2024) highlighted a scandium potential of 300 to 500 million tonnes grading approximately 40 ppm Sc2O3.

“The scandium resource potential is based on the drill holes on the property drilled for (July 25, 2024) maiden resource estimate for other metal content than scandium. The potential quantity and grade are conceptual in nature, there has been insufficient exploration to define a mineral resource, and it is uncertain if further exploration will result in the target being delineated as a mineral resource.”

Early metallurgical test work demonstrated that scandium could be extracted from copper flotation tailings. Subsequently, through an innovative robust test work programme at SGS Canada Inc., it has been successfully demonstrated that scandium in flotation tailings can be recovered to a high purity di-scandium tri-oxide product (Sc2O3).

Key metallurgical results include:

- Primary scandium extraction (leach): 82%

- Overall scandium recovery to high-purity Sc2O3 product: 88%

Future work to advance the Hat project will focus on continuous pilot plant testing and further optimization to improve primary extraction and enhance final product purity.

Farshad Shirvani, President and CEO of Doubleview Gold Corp., stated:

“Today’s results are a game-changer for the HAT project and potentially for the entire scandium industry on the world stage. World scandium supply is severely limited although there are several scandium projects currently being considered for development. Our metallurgy program shows that at HAT, we can recover high-value scandium directly from the tailings of a standard copper flotation circuit, using acid produced from internally generated pyrite. If the HAT project advances to production, scandium could become a high-margin bonus on top of a potential world-class copper-gold-cobalt operation.

Now that we’ve established the technical viability of scandium recovery, the next steps will focus on pushing extraction and overall recovery as high as possible through continued optimization and pilot-scale testing. I could not be more excited about what the future holds for Doubleview shareholders and all our stakeholders.”

The pictures below show the first Scandium Oxide (Sc2O3) produced from the Hat Deposit in the lab. Doubleview now plans to continue its metallurgical optimization program to enhance the recovery of scandium and other metals, including copper, cobalt, gold, and silver, which are critical for the upcoming prefeasibility study.

Photo 1: Scandium Oxide (Sc2O3) from the Hat deposit

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8003/275884_4b60eef9a4ae6b97_001full.jpg

Photo2: Scandium Oxide (Sc2O3) from the Hat deposit

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8003/275884_4b60eef9a4ae6b97_002full.jpg

Qualified Person:

EUR ING Andrew Carter B.Sc., CEng., MIMMM (QMR), MSAIMM, SME, Doubleview’s Qualified Person with respect to the HAT Project metallurgical studies as defined by National Instrument 43-101, has reviewed and approved the technical content of this news release and is independent of the Company.

What is Scandium?

Scandium (Sc) , (atomic weight 45.10, density 2.5), a close relative of the Rare Earth elements, possesses exceptional properties when alloyed with other metals, particularly aluminum. It is lightweight, corrosion-resistant, and as an alloy is capable of dramatically improving strength, heat resistance, and weldability without adding significant weight. When combined with aluminum, scandium forms alloys that achieve the strength of steel while maintaining the light weight of aluminum, enabling revolutionary applications in transportation, aerospace, and clean energy. Scandium’s scarcity, produced in limited quantities globally, primarily as a byproduct, makes it a high-value critical mineral, with prices often exceeding $5,000 per kilogram. Its applications span aerospace, defense, and increasingly, the clean energy sector, where it plays a pivotal role in advancing sustainable technologies. Global scandium resources are dominated by projects in Australia and northern Europe. Canadian deposits potentially can allow diversity of supply within a stable and mature mining jurisdiction.

About Doubleview Gold Corp

Doubleview Gold Corp (TSXV: DBG) (OTCQB: DBLVF) (FSE: 1D4) is a Canadian resource company advancing the 100%-owned Hat Polymetallic Project, located in the prolific Golden Triangle of northwestern British Columbia. The Hat hosts a large copper-gold-cobalt-scandium porphyry system with significant critical metal potential. Doubleview is dedicated to responsible exploration, Indigenous engagement, and sustainable development that benefits both shareholders and local communities.

Doubleview’s success is deeply rooted in the unwavering support of its long-term shareholders, supporters, and institutional investors. Their ongoing commitment has been instrumental in advancing the company’s strategic initiatives. Doubleview looks forward to further collaborative growth and development and continues to welcome active participation from its valued stakeholders as the company expands its portfolio and strengthens its position in the critical minerals sector.

For more information, please visit: www.doubleview.ca

About the Hat Polymetallic Deposit

The Hat Deposit, located in northwestern British Columbia, is a polymetallic porphyry project with major resources of copper, gold, cobalt, and the potential for scandium. As one of the region’s significant sources of critical minerals, the Hat deposit has undergone targeted exploration and development. The 0.2% CuEq cut-off resource estimate, as of the recently completed Mineral Resource Estimate and the Company’s July 25, 2024, news release, is summarized below:

| Open Pit Model Hat | Average Grade | Metal Content | ||||||||||

| Resource Category | Tonnage | CuEq | Cu | Co | Au | Ag | CuEq | Cu | Co | Au | Ag | |

| Mt | % | % | % | g/t | g/t | million lb | million lb | million lb | thousand oz | thousand oz | ||

| In Pit | Indicated | 150 | 0.408 | 0.221 | 0.008 | 0.19 | 0.42 | 1,353 | 733 | 28 | 929 | 2,045 |

| Inferred | 477 | 0.344 | 0.185 | 0.009 | 0.15 | 0.49 | 3,619 | 1,945 | 91 | 2,328 | 7,575 | |

Scandium potential for the Hat Deposit is estimated to be 300 to 500 million tonnes at an average grade of 40 ppm (0.004%) Sc2O3.

For further details of the MRE, please refer to the Company’s July 25, 2024 news release.

On behalf of the Board of Directors,

Farshad Shirvani, President & Chief Executive Officer

For further information please contact:

Doubleview Gold Corp

Vancouver, BC Farshad Shirvani

President & CEO

T: (604) 678-9587

E: corporate@doubleview.ca

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains “forward-looking information” and “forward-looking statements” within the meaning of applicable securities legislation (collectively, “forward-looking statements”). Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. All statements, other than statements of historical fact, are forward-looking statements and are based on predictions, expectations, beliefs, plans, projections, objectives and assumptions made as of the date of this news release, including without limitation: the size of the Private Placement and other statements concerning the Private Placement; the anticipated use of proceeds from the Private Placement; the renunciation to the purchasers of FT Shares and timing thereof; the tax treatment of the FT Shares and the Company’s plans regarding exploring its mineral exploration properties; anticipated results of geophysical drilling programs, geological interpretations and potential mineral recovery. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate funding on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company’s expectations; risks related to the gold price and other commodity price fluctuations; and other risks and uncertainties related to the Company’s prospects, properties and business detailed elsewhere in the Company’s disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty or reliance on forward-looking statements. These forward-looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise any forward-looking statements, other than as required by applicable law, to reflect new information, events or circumstances, or changes in management’s estimates, projections or opinions. Actual events or results could differ materially from those anticipated in the forward-looking statements or from the Company’s expectations or projections.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/275884