Military Metals Corp. (CSE: MILI) (OTCQB: MILIF) (FSE: QN90) (the “Company” or “MILI”) is pleased to report the commencement of a 10 hole, 2500-meter, definition drilling campaign at the company’s 100% owned flagship Trojarová Antimony Gold Project (the “Project”) in Slovakia, and the appointment of David Murray P.Geo as Vice President of Exploration.

Highlights of the Campaign Include:

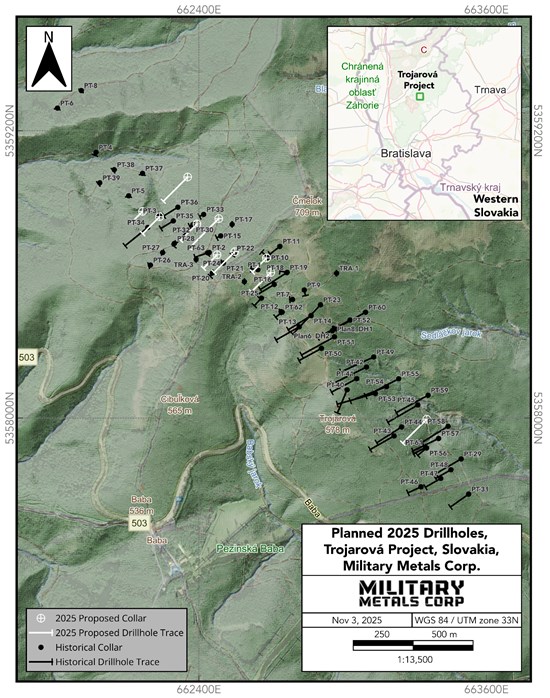

- Up to 10 diamond drillholes (see drill hole map below)

- Up to 2500m of drilling

- 7 holes designed to confirm historical drilling results and update SLR Consulting’s ongoing mineral resource estimate on the Project

- 3 holes designed to test the deposit for NW strike continuity

Scott Eldridge, Chief Executive Officer of the Company, commented, “The commencement of this drilling campaign at our flagship Trojarová Project is a milestone achievement. The results of this program will allow for the completion of the Project’s mineral resource estimate early in 2026 and serve as a launch pad for continued advancement of this strategic asset. Furthermore, on behalf of the board, management and our shareholders, I am excited to welcome David Murray as our Vice President of Exploration. He brings 15 years of international mineral industry experience. I look forward to working directly with David to unlock the geological potential of our antimony portfolio. His technical skills will be an asset to the Company. I also wish to sincerely thank Mr. Avrom Howard for his invaluable contributions to the role of VP Exploration over the past year.”

History of the Project and Historical Resource

Discovered nearly fifty years ago, Trojarová was the focus of extensive surface and underground exploration over 2km of strike length between 1983 and 1995, including 63 diamond drillholes totaling 14,330 meters, and 1.7 kilometers of underground workings. Historical exploration efforts culminated in a historical mineral resource estimate published by the Slovak Geological institute in 1992 (see “Historical Resource Estimates” below). Per this historical estimate, at a cut-off grade of 1.0% antimony, Trojarova hosts 2.46 million tonnes averaging 2.47% antimony and 0.635 grams per tonne gold in a mineralized zone averaging 3.32 meters wide, containing approximately 60,000 tonnes of antimony insitu. The historical estimate at Trojarová was classified using the Slovak version of the newly post-Soviet Russian classification system, which uses categories not directly comparable to modern standards as defined by the Canadian Institute of Mining, Metallurgy & Petroluem (“CIM”) Definition Standards for Mineral Resources & Mineral Reserves. The Slovak Geological Institute, the State agency that carried out all exploration and underground development work at Trojarová, classified the resource as “P1” in the Slovak version of the Russian classification system. P1 is most comparable in CIM’s classification system to “Inferred Mineral Resources,” which is defined by the CIM as that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of limited geological evidence gathered through appropriate sampling techniques from locations such as outcrops, trenches, pits, workings and drill holes. A qualified person has not done sufficient work to classify the historical estimate as current, and the Company is not treating the historical estimate as current. For additional information relating to the historical estimate see below under the heading “Historical Resource Estimates”.

The Company announced January 8th, 2025, that SLR Consulting had been engaged to complete a modern mineral resource estimate of the Trojarová Project. The current drill program supports this work by seeking to confirm historical results and validate preliminary resource models.

Preliminary modelling of historical data indicates the Trojarová deposit may display a trend of thickening and increasing antimony grades to the NW. The Company has targeted projected extensions of the deposit along this vector with 3 of the 7 planned drillholes with the aim to expand the current extents of the known deposit.

Appointment of New Vice President of Exploration

Mr. Murray is a professional geoscientist with 15 years of experience in mineral exploration and mining. His technical experience has been gathered throughout the Americas and Europe in exploration and resource geology roles, with various technical consultancies and major mining companies including Goldcorp and Newmont. David’s commodity experience is diverse specializing in orogenic gold systems and including porphyry deposits, volcanogenic massive sulphide (VMS) deposits, magmatic Ni + Cu + PGE, carbonate hosted Zn, Pb + Ag, HREE and LREE as well as LCT Li pegmatites and Li brine deposits. Mr. Murray holds a Bachelor of Science with an Advanced Major in Geoscience from St. Francis Xavier University in Antigonish, Nova Scotia.

Mr. Murray’s top technical priority will be to unlock shareholder value through the definition and growth of mineral resources at Trojarová and MILI’s other antimony and related critical metals projects, along with assessing additional opportunities that may come to the Company’s attention. MILI welcomes him to its executive management team on behalf of the Company’s shareholders.

Figure 1. Historical and proposed diamond drillholes at the Trojarová antimony & gold project, western Slovakia.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10818/273101_a4491c4ef4c25abc_001full.jpg

About the Project

Discovered in the late 1970s, Trojarová was the focus of extensive surface and underground exploration from 1983 to 1995, with 63 core holes for a total of 14,330m, and 1.7km of underground workings completed. Efforts continued over the years as additional trenches were dug, and holes were drilled. Starting in 1990, underground development work began ultimately comprising a 300-meter-long adit connected to a 700-plus meter-long drive in the footwall of the mineralized zone with seven crosscuts into the mineralized zone for sampling purposes. These efforts culminated in a multi-volume study comprising drill logs, analyses, drill plans, maps and sections, deposit model studies, petrographic studies, metallurgical studies and more, culminating in a multi-volume compendium of reports produced by the Slovak Geological Institute published in 1992.

Options Grant

The Company is pleased to announce it has granted an aggregate of 300,000 stock options (the “Options“) to David Muray to purchase 300,000 common shares (the “Shares“) in the capital of the Company pursuant to the Company’s share option plan (the “Option Grant“). The Options, which vest immediately, are exercisable at an exercise price of $0.50 per Share for a period of five years from the date of grant.

The technical contents of this release were reviewed and approved by David Murray, P.Geo, VP-Exploration for Military Metals and a qualified person as defined by National Instrument 43-101.

For more information about Military Metals Corp. and its critical minerals initiatives, please visit: https://www.militarymetalscorp.com.

LinkedIn:

https://www.linkedin.com/company/military-metals/

X: https://x.com/militarymetals

Facebook: https://www.facebook.com/profile.php?id=61564717587797

About Military Metals Corp.

The Company is a British Columbia-based mineral exploration company that is primarily engaged in the acquisition, exploration and development of mineral properties with a focus on antimony.

ON BEHALF OF THE BOARD of DIRECTORS

For more information, please contact:

Scott Eldridge

CEO and Director

scott@militarymetalscorp.com or info@militarymetalscorp.com

For enquiries, please call 604-537-7556

Historical Resource Estimates

This news release includes disclosure of a historical resource estimate. A qualified person has not done sufficient work to classify the historical estimate included in this Presentation as current mineral resources or mineral reserves. The Company is not treag the historical estimate as current mineral resources or mineral reserves.

The historical estimate quoted in this Presentation related to the Trojarova Property was taken from a compendium produced by the Slovak Geological Survey, completed in March 1992 based on exploration work undertaking in the 1980s and 1990s. It is entitled (English translation): “FINAL JOB REPORT, PEZINOK-TROJAROVA, Geological Survey State Enterprise”, report compendium number 78406 (Michel et al, 1992).

The Slovak Geological Institute, the state agency that carried out all exploration and underground development work at Trojarová, classified the historical resources as “P1” and “C2” in the Slovak version of the Russian classification system, respectively. These are closest within the Canadian Institute of Mining, Metallurgy & Petroleum’s (“CIM”) classification system to “inferred mineral resources,” which is defined by the CIM as that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence gathered through appropriate sampling techniques from locations such as outcrops, trenches, pits, workings and drill holes.

The historical work carried out appears comprehensive, detailed and at a professional standard. The Company considers this historical data to be relevant as the Company will use these data as a guide to plan future exploration programs. The Company also considers the data to be reliable for these purposes. However, considerable work needs to be completed before it will be possible to classify mineralization documented at Trojárova as current mineral resources. The historical drill logs need to be translated and transcribed into a logging format suitable for resource estimation purposes. All historical collar locations along with the underground maps need to be digitized and georeferenced. All data need to be transferred to an independent, arm’s length resource estimation specialist so that a three-dimensional digital deposit model can be constructed, based upon which the number, length and orientation of twin and infill holes necessary so that the historical resource can be classified as current mineral resources can be determined.

Forward-Looking Information

This news release contains “forward-looking information”. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or variations (including negative variations) of such words and phrases, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking information in this news release includes the future drilling and exploration work at Trojarová, the development of a custom antimony analytical standard, the continuation of the value of antimony, and the future needs of Europe and the E.U. specifically. A variety of factors, including known and unknown risks, many of which are beyond our control, could cause actual results to differ materially from the forward-looking information in this news release. These include geopolitical developments related to the supply and value of antimony, the continued use of antimony and availability of alternatives, availability of capital and labour in respect of the property that is the subject of this news release, the results of any future exploration activities, which cannot be guaranteed, and any other future activities in respect of the property held by the Target. Additional risk factors can also be found in the Company’s public filings under the Company’s SEDAR+ profile at www.sedarplus.ca. Forward-looking statements contained herein are made as of the date of this news release and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward looking statements if circumstances, management’s estimates or opinions should change, except as required by securities legislation. Accordingly, the reader is cautioned not to place undue reliance on forward-looking statements.

The Canadian Securities Exchange has neither approved nor disapproved the information contained herein and does not accept responsibility for the adequacy or accuracy of this news release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/273101