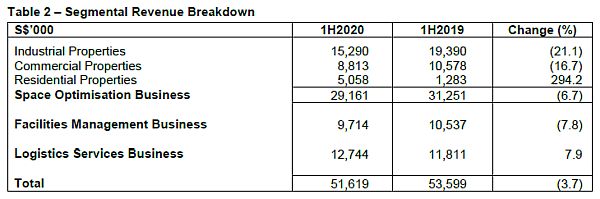

– Residential Properties segment under the Space Optimisation Business registered a revenue growth of 294.2% in 1H2020 as compared to 1H2019 due to increase in revenue from the co-work co-live business at 31 Boon Lay Drive and the new serviced residence project in Myanmar.

– The Group’s Logistics Services Business continue to deliver consistent revenue growth of 7.9% in 1H2020.

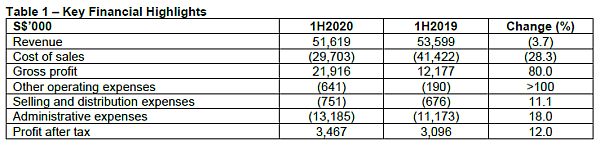

Real estate management services group LHN Limited (“LHN”, and together with its subsidiaries, the “Group”) achieved a net profit after tax of approximately S$3.5 million for the six months ended 31 March 2020 (“1H2020”).

The Group’s revenue decreased by 3.7% from approximately S$53.6 million in 1H2019 to approximately S$51.6 million in 1H2020, due to decrease in revenue from the Industrial Properties and Commercial Properties from the Space Optimisation Business and the Facilities Management Business. The decrease was partially offset by the increase in revenue from the Residential Properties of our Space Optimisation Business and Logistics Services Business.

Cost of sales decreased by 28.3% from approximately S$41.4 million in 1H2019 to approximately S$29.7 million in 1H2020, due to a decrease in (i) manpower cost under the Facilities Management Business as a result of the disposal of the security services business in May 2019; and (ii) rental costs due to the adoption of IFRS 16 on 1 October 2019. The decrease was partially offset by the increase in (i) depreciation of right-of-use assets due to adoption of IFRS 16; (ii) upkeep and maintenance costs mainly from the Facilities Management Business and Logistics Services Business; and (iii) depreciation of property, plant and equipment.

Space Optimisation Business contributed 56.5% of the Group’s total revenue for 1H2020. Residential Properties segment contributed a rise of 294.2% in revenue mainly due to increase in revenue of approximately S$3.2 million mainly from the co-work co-live business at 31 Boon Lay Drive Singapore which started to generate revenue from the second quarter of our financial year ended 30 September 2019 (“FY2019”); and (ii) revenue of approximately S$0.6 million from our new serviced residence project in Myanmar which started to generate revenue in the fourth quarter of FY2019.

However, revenue from Industrial Properties declined by 21.1% in 1H2020 as compared to 1H2019 mainly due to derecognition of revenue of approximately S$5.1 million from subleases classified as finance lease and the net gain was recognised to retained earnings on 1 October 2019 upon adoption of IFRS 16.

The decrease for the Industrial Properties was partially offset by (i) increase in rental income as a result of higher occupancy rates; and (ii) the contribution of rental income from one new property acquired and tenanted since the second quarter of FY2019.

The average occupancy rate of the Group’s Industrial Properties increased by 2.1 percentage points to approximately 89.9% in 1H2020 as compared to 87.8% in 1H2019.

For the Commercial Properties, revenue declined by 16.7% in 1H2020 as compared to 1H2019 mainly due to (i) the movement of tenants due to expiry of subleases; (ii) renewal of subleases at lower rate; and (iii) derecognition of revenue of approximately S$0.8 million from subleases classified as finance lease and the net gain was recognised to retained earnings on 1 October 2019 upon adoption of IFRS 16.

The average occupancy rate of the Group’s Commercial Properties decreased by 6.0 percentage points to approximately 84.5% in 1H2020 as compared to 90.5% in 1H2019.

The Group’s Facilities Management Business declined by 7.8% in 1H2020 from approximately S$10.5 million in 1H2019 to approximately S$9.7 million in 1H2020 due to the absence of revenue of approximately S$2.6 million from the security services business as a result of the completion of the disposal of the security services business as disclosed in the announcement dated 31 May 2019. This was partially offset by the increase in (i) revenue of approximately S$1.5 million from the management of new carparks in Singapore and Hong Kong; and (ii) revenue of approximately S$0.3 million from the increase in facilities management services provided.

The Group’s Logistics Services Business continued to produce incremental revenue growth, rising 7.9% from approximately S$11.8 million in 1H2019 to approximately S$12.7 million in 1H2020 mainly due to increase in transportation services provided from the trucking business and an increase in demand for storage and repairs of leasing containers in Thailand.

Table 1: http://www.acnnewswire.com/topimg/LHN_1H20201.jpg

Table 2: http://www.acnnewswire.com/topimg/LHN_1H20202.jpg

Business Outlook

The coronavirus (“COVID-19”) pandemic has led to a severe contraction in economic activity both in Singapore and globally, due to the combination of supply chain disruptions, travel restrictions imposed in many countries and a sudden decline in demand. The Singapore economy will enter a recession this year, with GDP growth projected at -4% to -1%[1].

Based on advance estimates as announced in the press release dated 26 March 2020 issued by the Ministry of Trade and Industry Singapore[2], the Singapore economy contracted by 2.2% on a year-on-year basis in the first quarter of 2020, reversing the 1.0% growth in the preceding quarter. On a quarter-on-quarter seasonally-adjusted annualised basis, the economy shrank by 10.6%, a sharp pullback from the 0.6% growth in the previous quarter.

As announced on 29 April 2020, the Group is assessing the potential impact of the circuit breaker measures announced by the Singapore Government on 3 April 2020[3] and 21 April 2020[4] and the Covid-19 (Temporary Measures) Act 2020 which was passed on 7 April 2020. For further details, please refer to the Company’s announcement dated 29 April 2020.

In view of the abovementioned, the Group expects that rental collections under its Space Optimisation Business are likely to be affected, in particular, for rental collections for subleases of the Group’s commercial and industrial properties.

For our overseas projects under the Space Optimisation Business, the spread of COVID-19 around the world has also resulted in the delay of the renovation of our leased property in Nanan City, Quanzhou, Fujian Province, the People’s Republic of China and the construction of our Axis Residences property in Cambodia. However, the Group expects both projects to be operational by the end of our financial year ending 30 September 2020.

As announced on 4 February 2020, Work Plus Store (Kallang Bahru) Pte. Ltd., a joint venture company of the Group, has completed the acquisition of a property at 202 Kallang Bahru in Singapore and is expected to commence renovations on or after 1 June 2020 due to the circuit breaker measures and subject to any further directive(s) from the Singapore Government.

With respect to the Facilities Management Business, the Group continues to seek more external facilities management contracts by providing integrated facilities management services covering repair, maintenance and cleaning of buildings and offices, pest control and fumigation.

For the carpark business in Singapore, the Group expects a potential decrease in parking activity in view of the circuit breaker measures and safe distancing measures implemented by the Singapore Government since March 2020.

With respect to the Logistics Services Business, the Group remains cautious as a decrease in logistics services and a delay in collection of receivables may be possible in the coming periods given the decline in global economic activity.

Looking ahead, the Group will monitor the situation carefully and will make further announcement(s) as and when there are material development(s) to the abovementioned matters.

[1] https://www.mas.gov.sg/-/media/MAS/EPG/MR/2020/Apr/MRApr20.pdf

[2] https://www.singstat.gov.sg/-/media/files/news/advgdp1q2020.pdf

[3] https://tinyurl.com/y76hlsuj

[4] https://tinyurl.com/y7xahhrz

About LHN Limited

LHN Limited (the “Company”, and together with its subsidiaries, the “Group”) is a real estate management services group, with the ability to generate value for its landlords and tenants through its expertise in space optimisation, and logistics service provider headquartered in Singapore.

The Group currently has three (3) main business segments, namely: (i) Space Optimisation Business; (ii) Facilities Management Business; and (iii) Logistics Services Business, which are fully integrated and complement one another.

Under its Space Optimisation Business, the Group primarily secures master leases of unused, old and under-utilised commercial, industrial and residential properties and through re-designing and planning, transforms them into more efficient usable spaces, which are then leased out by the Group to its tenants.

Space optimisation generally allows the Group to enhance the value of properties by increasing their net lettable area as well as potential rental yield per square feet.

The Group’s Facilities Management Business offers car park management services and property maintenance services such as cleaning, landscaping, provision of amenities and utilities, and repair and general maintenance principally to the properties it leases and manages, as well as to external parties.

Under its Logistics Services Business, the Group provides transportation services, container depot management services and container depot services. The Group transports mainly ISO tanks, containers, base oil and bitumen, provides container depot management services and provides container depot services which include container surveying, container cleaning, on-site repair and storage of empty general purpose and refrigerated containers (reefer).

The Group currently operates mainly in Singapore, Indonesia, Thailand, Myanmar, Malaysia and Hong Kong.

Issued for and on behalf of LHN Limited

For more information please contact:

Jess Lim Bee Choo

Group Deputy Managing Director

E-mail: jess.lim@lhngroup.com.sg